Part 1: Enhancing Customer Experiences with Cloud Communications

Part 2: Maintaining Relationships During a Pandemic

Part 3: It’s a New Day—STIR/SHAKEN & Long Code Texting Rules

The C-suite knows that omnichannel communications are vital to delivering the very best customer experience. So what aspects do they value most? How do they go about selecting a provider?

A full 61% of our CPaaS survey respondents said that their customers have made a purchase—or not— based on specific communications features (while another 16% “don’t know”); 73% already include some messaging capabilities and 90% have some voice functionality.

A full 61% of our CPaaS survey respondents said that their customers have made a purchase—or not— based on specific communications features (while another 16% “don’t know”); 73% already include some messaging capabilities and 90% have some voice functionality.

Plus, 36% of the average IT budget goes to communications.

Customer Experience Reigns

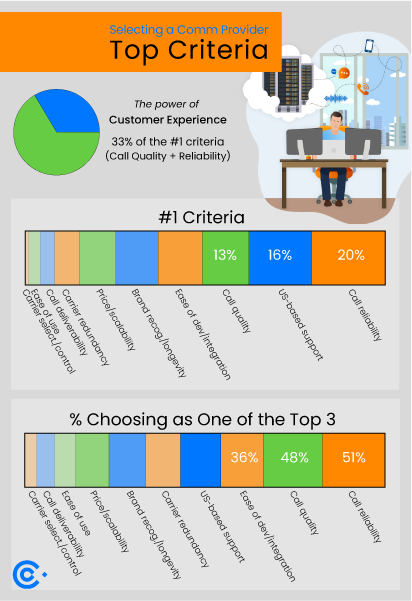

We are pleased to see the emphasis placed on their customers’ experiences, as defined by call quality and reliability, with 33% of respondents saying it’s the top criteria.

We must question, however, whether criteria such as carrier selection/ control and redundancy are being sufficiently valued with just over one and seven percent of the vote respectively even though they correlate directly to those customer experiences: if quality is the what, carrier options are the how.

We are also intrigued to see US-based support as the second-highest top criteria, and ease of development/integration the third highest criteria to round out the top three. These are important features, particularly for small- to mid-size organizations, and we routinely hear from our customers that they left their former providers due to both being in short supply.

Interestingly, price did not score more highly as one of their top criteria, although we suspect pricing scalability will become increasingly necessary as their businesses—and their communications—grow. (This is a very common theme we hear as a reason customers switch to Commio as they scale.)

Expert Resources…Or Not

We also asked respondents where they find their information and recommendations about providers. A full 40% said they don’t attend trade shows, although it was unclear the extent to which this is tied to the pandemic. The most popular events cited were ITExpo (27%), followed by Twilio events (26%). Sixteen percent attend Enterprise Connect, while all other shows are under 10% combined.

When asked about blogs, only a third said they read one regularly and there was no consensus about which blog they read; nor were there many publication readers (less than a third responded) or any popular options—few of which are primarily about communications.

Gartner Peer Insights is the most commonly used review site when shopping for a CPaaS solution at 34%, seconded by None at 32%. These are followed by G2, SourceForge, and Capterra at 27%, 22%, and 21% respectively.

Gartner, as one might expect, is the most popular analyst group at virtually half (49%). Second once again is None at 40%, while Frost & Sullivan came in third with 22%.

Overall, it seems that a large percentage of these companies are making decisions with little input from expert external resources, which is surprising given the complexity of the subject matter and the relatively large portion of the budget that communications consumes—as well as its criticality to customer experience.

According to last month’s Buyer Behavior Report from peer review site G2, whose respondents were more enterprise-centric, “Nearly 60%…indicate they always conduct research.” While our SME data suggests a somewhat lower overall percentage, we concur with their conclusion: “Businesses should take full advantage of the expanding range of tools and information.”

Who’s Involved in Purchasing Decisions?

Last but not least, we asked who at their company is involved in the selection process—both the decision makers and the influencers. Here it is clear that the C-suite takes the decision very seriously. Almost 60% of respondents said the CEO/CTO/president/founder/owner is the final decision maker for which voice or messaging solution to purchase. Another 20% of the time, the decision is made by a vice president, and an additional 16% of decisions are made by a head of technology/IT specialist/network engineer. The C-suite is an influencer in more than 65% of the companies, while the vice president is involved over 50% of the time and the “head of technology” group 43%.

In the more enterprise-heavy G2 report, IT departments were the largest decision makers at 43%, while only 19% of C-level executives make the software purchasing decision.

Over 60% of respondents are involved in every step of the process, as well, from problem identification (64%) and vendor identification, research, and selection (64-61%), all the way to implementation (68%) and even daily usage (56%). This is clearly a critical component of small- to mid-size SaaS businesses; and while this responsibility gets pushed down a bit in larger companies, it’s still an important part of their focus.

Part 1: Enhancing Customer Experiences with Cloud Communications

Part 2: Maintaining Relationships During a Pandemic

Part 3: It’s a New Day – STIR/SHAKEN and 10DLC Messaging Rules

Part 4: The Ideal Cloud Communications Provider

Part 5: What Keeps The SaaS C-Suite Up at Night

Part 6: How SaaS Companies Change as They Grow

Download the Cloud Communications Survey White Paper for full results

See the Survey Webinar Video